The war began on the 7th of October 2023. The war received global attention due to the unexpected nature of attacks on both sides.

The global economy has been impaired by multiple shocks in the last five years such as the US-China trade war in 2019, the coronavirus COVID-19 pandemic in 2020, the Russia-Ukraine war in 2022, the post-pandemic global inflation in 2023 and more recently the Israel-Hamas war beginning from October 2023 to 2024. Prior to the Israel-Hamas war, many countries witnessed severe food shortages, high energy prices and food price inflation due to the Russia-Ukraine war which had a direct impact on global food prices and energy prices. The COVID-19 pandemic also led to economic shocks though global supply chain disruptions which led to inflation and slowdown in economic activities.

- Increasing volatility of global financial markets - This uncertainty led to volatility in global financial markets and eroded confidence in financial markets, leading to a crash in asset prices.

- Rise in oil price - Since the start of the war, oil price exceeded $90 a barrel and may rise higher if the war escalates to the entire Middle East region.

- Decline in tourism and travel - Tourism and air travel to and from Israel decreased by 75 per cent in November and December of 2023 due to the conflict, according to the Israeli Airports Authority. Israeli airline companies lost about $155 million since the beginning of the Israel-Hamas war according to the Israeli Airports Authority.

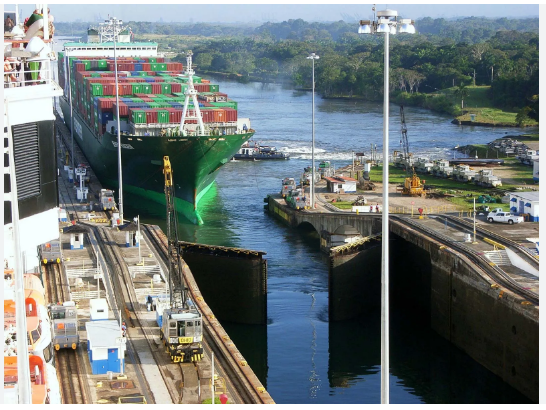

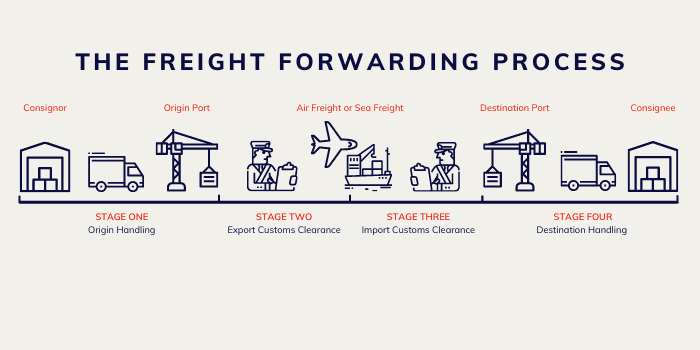

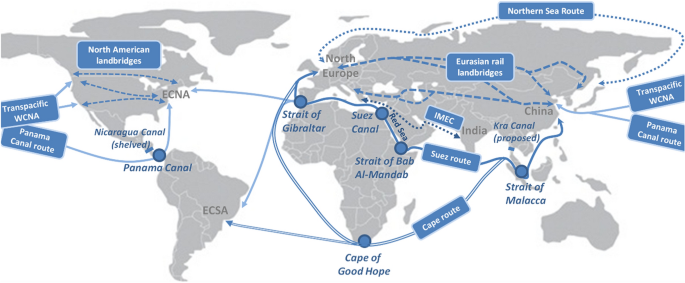

- Increase in the cost of insurance - The war escalated to the red sea where Yemeni-based Houthi rebels attacked and damaged more than a dozen Red Sea vessels since the start of the Israel-Hamas war. This led to increase in the price of imported goods and increase in inflation in import-dependent countries.

- Rising cost for businesses and delay in decision making - Furthermore, uncertainty about the outcome of the war and whether it would escalate across the region and disrupt trade grew among businesses and it led businesses to delay decision making. Such uncertainty caused firms to delay investment and hiring decisions and increase risk premia on new business decisions.

- GDP growth - Since the start of the war (see figure 4), the GDP of Israel fell to an all-time low. Israel’s annual GDP growth decreased from 3.4 percent in the third quarter to -3.519 percent in the fourth quarter of 2023. Neighbouring countries, like Saudi Arabia, witnessed negative GDP growth of -3.7 percent in the fourth quarter of 2023 while Iran witnessed a decrease in GDP growth. Meanwhile, countries such as the UK and Germany which are distant from Israel in geography but supported Israel’s war in Gaza also witnessed negative GDP growth rates, indicating spill over of the war to those countries. Furthermore, countries that remained neutral during the Israel-Hamas war witnessed positive GDP growth such as Italy, China, and Nigeria. Overall, there is evidence of spill-over of the war to other countries as neighbouring countries witnessed a decline in annual GDP growth such as Iran and Saudi Arabia, while distant countries such as New Zealand, Germany and the UK also witnessed a decline in GDP growth.

- Inflation rate - The inflation rate of Israel has declined since the start of the war. It declined from 3.7 percent in October 2023 to 2.6 percent in January 2024. This was largely due to the adoption of war-time monetary policy in Israel. The inflation rate of other countries that are distant from Israel also declined during the war. For instance, the inflation rate in South Africa, Japan, New Zealand, and France declined between October 2023 to January 2024. Meanwhile the inflation rate increased in other countries that are distant from Israel such as Nigeria and the UK.

- Global business sentiment using global PMI - The global purchasing managers index (PMI) shows the perceptions about the level of economic activities from private sector manufacturing firms particularly from product managers who buy the materials needed for a company to manufacture its products.

- Disruption to trade and global supply chain - The Global Supply Chain Pressure Index (GSCPI), which measures the intensity of disruptions to global supply chains, shows that the index fell to -0.38 in October 2023 and to -0.11 in January 2024. The war led to cross-border blockages on land, sea, and air, thereby disrupting trade supply chains.

- Other implications of the Israel Hamas war - Other than the global economic effects identified above, the war also had other effects. The war led to a humanitarian disaster in Gaza. It led to life-threatening shortages of water, electricity, fuel, food, and life-saving medical supplies. The war also led to the blockade of trucks carrying humanitarian aid into Gaza and compromising access to safe drinking water. The bombardments by Israel destroyed neighbourhoods, schools, and mosques, healthcare centres, and other civilian infrastructure.

The findings show that there was increased volatility in global financial markets, higher energy prices, decline in revenue from tourism and travels, disruption in trade and global supply chains, increase in the cost of insurance, recession risks, high inflation, rising cost for businesses and delay in business decision making. There is also evidence of spill-over of inflation and GDP shocks to other countries during the war.